Understanding inflation and its impact

TLDR: what is inflation and how does it impact your returns

Inflation - something we hear constantly in financial news all the time. When too much of it is bad and is called Hyperinflation like what is currently happening in Venezuela. When there is not enough it is called deflation which was happening in most of Europe until recently.

Without going to the extremes of hyperinflation or deflation at the other end, inflation is an important concept to understand. Without going too much into the economics of the market inflation is a fine line between growth and affordability that most central banks try to influence by policies that they have at their disposal.

Some countries have an inflation target driven policy like the US where they want to hit a target of 2% inflation. Other countries like India struggle to contain inflation which leads to purchasing power issues that affect to poor and middle class.

Real returns

The inflation figure gives us a view of the real returns that our investment produces. The S&P 500 returns around 7 to 8% over the last 25 years. But the SENSEX has returned 17 to 19% over the same time period. So Indian market is so much better than the US market right?

Not quite. These figure are purely the returns from the equity investments but not real returns.

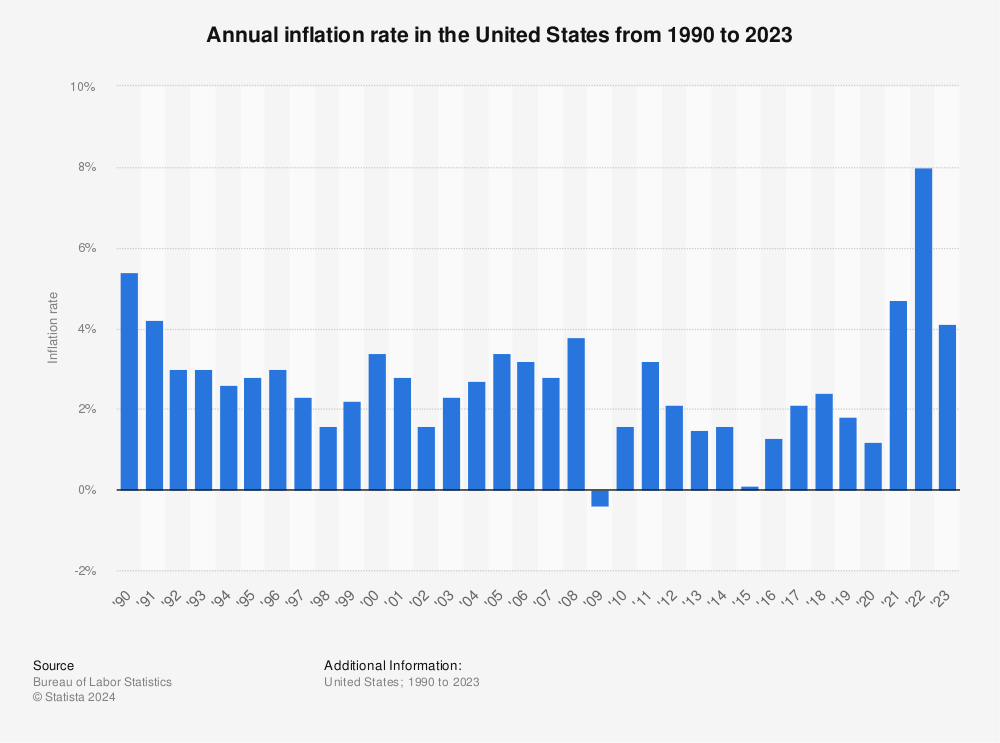

Find more statistics at Statista

The US inflation rate on average is around 2.5 to 3%.

Real returns = Equity returns - Inflation

So roughly 4 to 5% in case of US.

Source : inflation.eu

The average inflation in India has hovered around 7 to 9%.

So real returns of around 7 to 9%. But this is in Rupee terms, if you consider this in dollar terms it would drop further.

So the real returns expected from equity over the long term is 3 to 6% irrespective of which country you invest in, going by past performance.

Conclusion

When projecting your future needs include the good safety margin around inflation and assume real returns of 3 to 5% only so you will see where you land on your Financial Independence Retire Early journey and how much is the cushion that you need to get there.

Happy Investing.