My Index fund and ETF Q3 2022 portfolio review

TLDR - July to September 2022 Index fund & ETF portfolio review

July to September 2022

It has been an interesting period in the market, seems like a Q2 repeated into Q3 overall. All the same worries we had carried forward.

War in Ukraine has seem to have no end in sight

Crude prices up

Inflation still at an all time high across the globe

Fed rate increase is expected to push up borrowing costs across the world

The Recession word is being bandied around

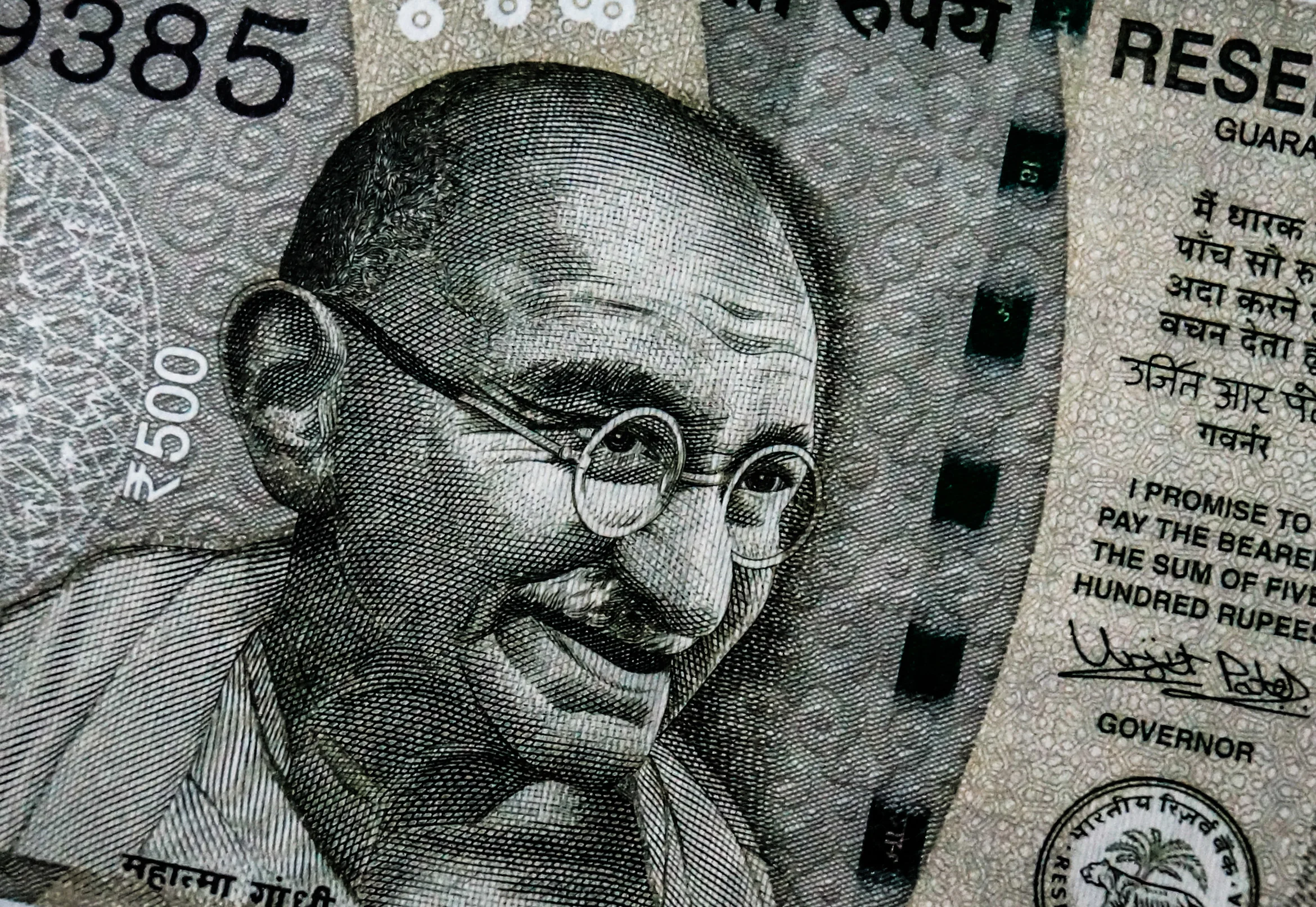

Markets have had several ups and downs. It has been very volatile but the Indian market has avoided the brunt of it for the most part. The US and rest of the developed world seemed to have faced more correction and selling pressure while the Indian market has been in positive territory for the most part.

Key index returns

A small change in the index returns calculation, NSEINDIA provides TRI (Total Returns Index) values, so from this quarter I am using TRI data instead of index performance.

How was the market return on key indexes for the last 3 months ending 30-Sep-22?

Nifty = 8.73 %

Nifty next 50 = 16.48 %

Nifty mid cap 150 = 16.51 %

Nifty small cap 250 = 14.33 %

If you were closely following the finance news you might not have expected to see this. Are you surprised that the market has ended the last three months on such a positive note? I didn’t until I was trying to compile the numbers.

My ETF Investments

No new investments into ETFs, so these are just organic growth

Current value 4-Oct-22

My Kuvera Index funds

Current value as of 4-Oct-22

My overall XIRR for each of the quarters this year

Q1 2022 - 27%

Q2 2022 - 10.7 %.

Q3 2022 - 18.49%

Lots of movements in all directions. This is XIRR as of the current time not really for the quarter but at a point in time. Since I contribute every month into these funds those will help average out across market conditions.

Conclusion

What is your take? How did your portfolio perform in the first quarter of the year? Did you stick to your plan? Did you add more?

Leave your comments below.

Happy Investing - #MyFatFIRE