FIRE journey so far

TLDR: A numbers journey of FIRE so FAR

Since I started this blog in Nov 2019, I have tried to make a minimum of 2 posts every month except for maybe this year. As work pressure has led me to take a breather on the blog. Super long days and nights at work means I am getting very little time to prep for the material and post on a regular basis.

So why not this post to take stock of the journey so far. I will try and list out all the different investments across platforms that I have and explain the justification and progress in each case. And what percentage of the FIRE target they have reached.

The FIRE target has to two numbers - One if I decide to FIRE in Singapore then expenses will be SGD and will be a much higher figure and the second one if I decide to move back to India where expenses will be in INR and lower.

So each of these savings will be X times my annual expected expense in both currencies.

Mandatory Savings

CPF - Central Provident Fund - (1.76X SGD / 6X INR)

All Singapore citizens and permanent residents are mandated by the law to contribute to CPF if they are salaried employees. So it is a way for the government to mandate savings by their citizens. Singaporeans fall into two camps on CPF, half treat it as a great way to save and the other half complain about the government trying to be the nanny state and direct how the citizens spend their money. I am part of the former group.

For my age group, the deductions are 20% of my salary up to the limit of 6,000 $ with a 17% contribution on top coming from my employer. A total of 37% = 2220$

Ever since becoming a permanent resident in 2010, I have been contributing towards this CPF

A big portion of CPF can be used to service your home mortgage and down payments which I have used up.

So a much smaller portion of the total remains, but still it is growing at a decent pace

Retirement Fund - (1.25X SGD / 4X INR)

My employer has a equivalent retirement scheme for non citizens and permanent residents to invest towards their retirement.

I had contributed towards that fund before I became a PR

Since the switch over to PR, this fund has no further contributions, but it has been growing over a period of nearly 15 years

Non Mandatory savings

Both of the above savings are mandated by the employer / Government so mandated. All of the other savings that is under non mandatory.

Emergency / Debt holdings (0.4X SGD / 1.25X INR)

I hold most of my emergency holdings spread across a few places.

SGS government bonds - Issued by Government of Singapore

Bank accounts - DBS / OCBC bank

Stashaway - RoboAdvisor

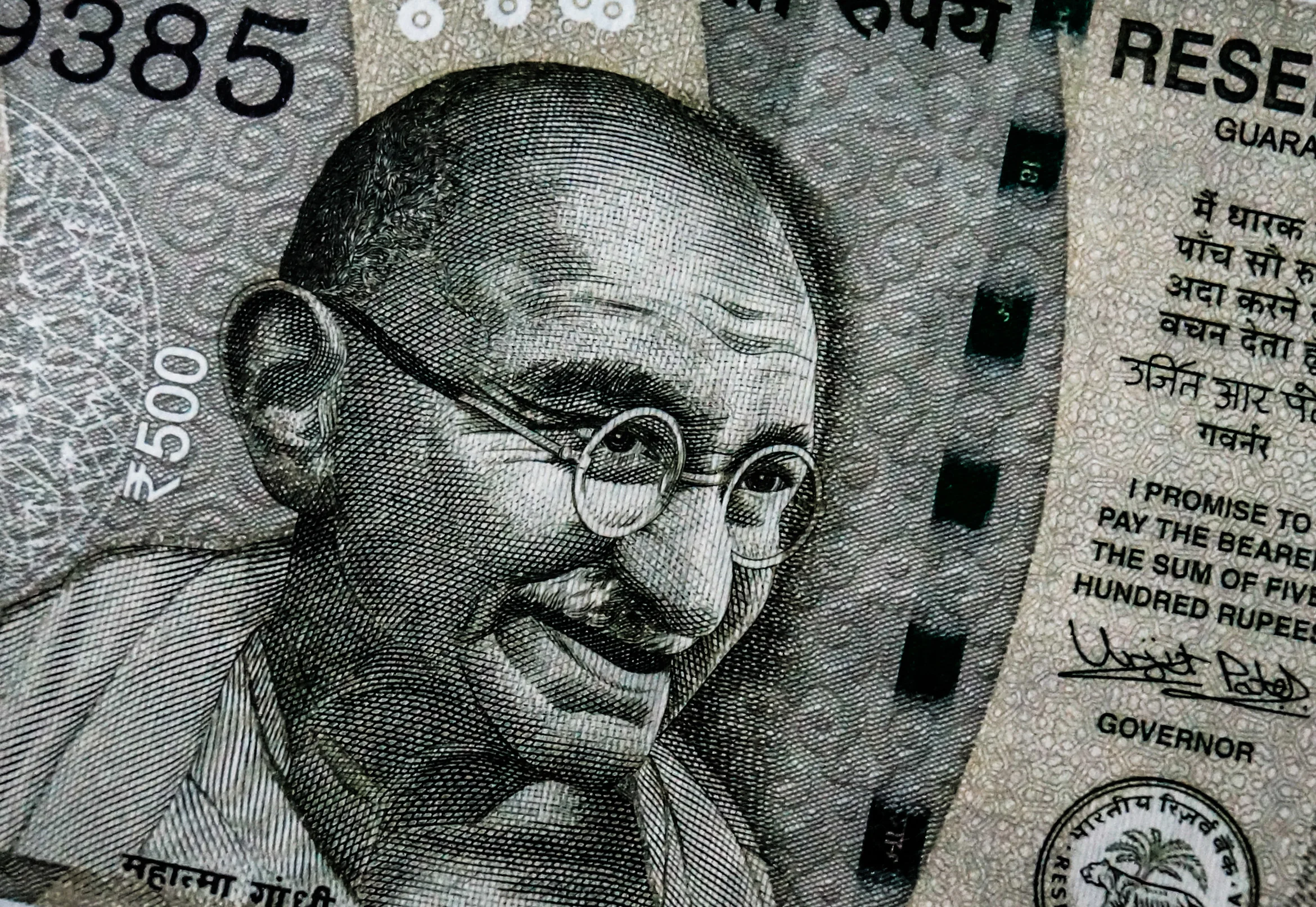

India portfolio (2.4X SGD / 7.64X INR)

Most of my India portfolio is held in index funds, ETFs and other mutual funds. This is a mix of equity and debt funds spread across different platforms and different fund houses.

ICICIDirect

Kuvera

Various fund houses

Global / SGP Portfolio (1X SGD / 3.1X INR)

I also hold a mix of ETFs and index funds across SGP and the globe for diversification and currency hedging purposes.

Others

I have not included real estate investments here as they are difficult to value and I didn’t really want to include them as a part of the market linked investments. This would also include gold and silver holdings which act as a inflation hedge but are a very small part of my overall portfolio.

Conclusion

With regards to SGD value, I am at 6.81X my annual expense figure not considering real estate and other misc holdings but at 22X in INR annual expenses. The aim from here on is to hit 7.5X SGD and 25X in INR annual expenses by end of the year.

Wish me luck.

How are you doing on your FIRE journey are you on track, did the bull market help you?

Leave your comments below.

Good Luck and Happy Investings

#MyFatFIRE